Luxury Real Estate IRR: Vetting Exit Strategy & Liquidity

Liquidity & Exit Strategy: The Silent Factor That Defines IRR in Luxury Real Estate

Disclaimer & Purpose

This article is designed as an educational and analytical tool for property investors and advisors to assess liquidity risk and plan exit strategies particularly within Phukets luxury real estate market.

All statistics and market insights presented are indicative only and should not be interpreted as individualized investment advice.

Investors are encouraged to consult financial and legal professionals before making any investment decisions.

Liquidity: The Silent Factor That Can Erase 10% of Your IRR

In real estate investment, most investors focus heavily on rental yield and IRR (Internal Rate of Return) but often overlook liquidity, a hidden factor that determines long-term profitability and exit success.

Liquidity represents how quickly a property can be sold at or near its fair market value (FMV).

If the property stays on the market too long (high DOM Days on Market), investors may face:

- Profit erosion: Expected IRR of 12 - 17% could shrink to just 7- 9%.

- Heavy discounts: Needing to close at 12 - 18% below FMV to exit within a reasonable timeframe.

You can read our related article: TIR Simulation: How to Achieve 17.20% IRR in Phuket Luxury Villas

Pain Points Investors Commonly Overlook

- Poor exit timing: Failing to align with economic cycles or seasonal pricing (e.g., Phukets high/low tourism periods).

- Lack of exit positioning: Not defining the buyer pool or resale segment early on.

- Liquidity traps: Over-investing in ultra-luxury assets (e.g., 120M+ villas) where the buyer base is extremely limited.

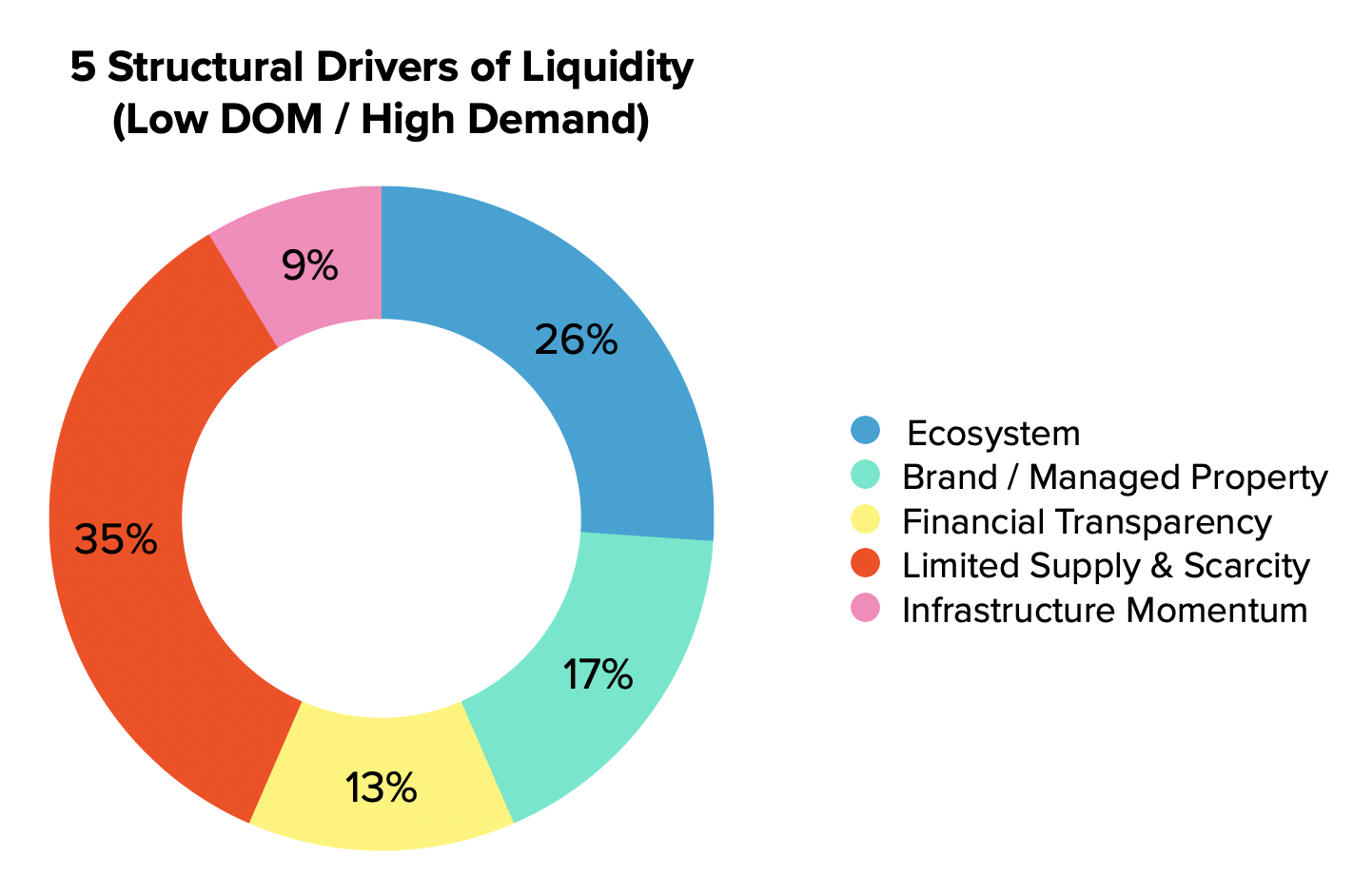

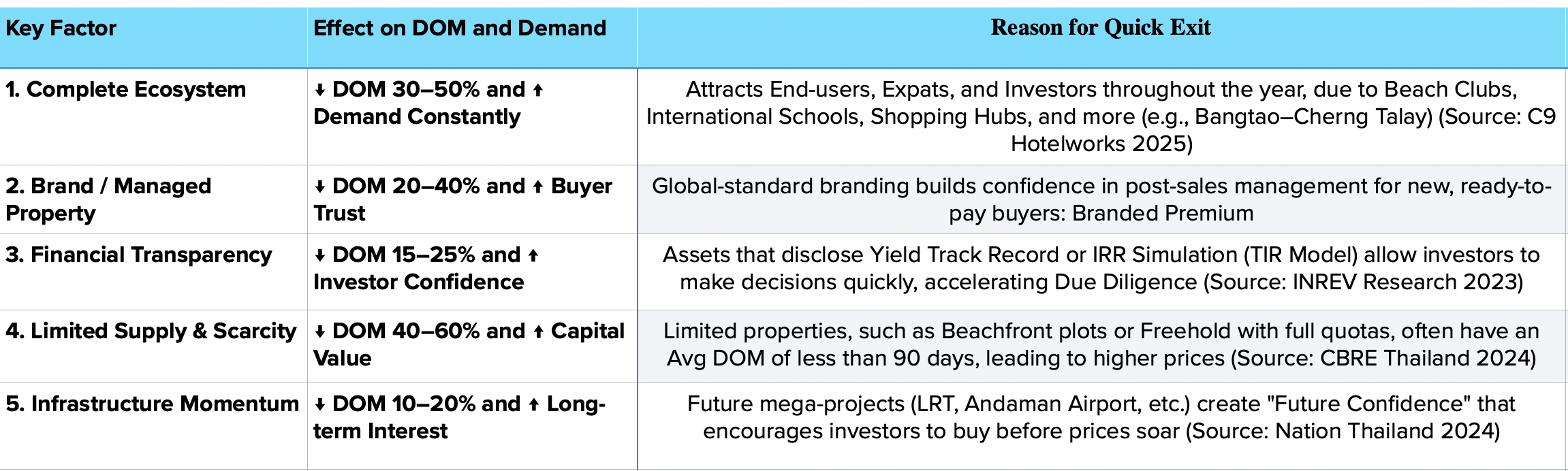

5 Structural Drivers of Liquidity (Low DOM / High Demand)

DOM (Days on Market) and market demand are strongly influenced by structural ecosystem factors.

To ensure your asset remains liquid and competitive, evaluate these five key components:

See related analysis: The Ecosystem Effect How Location Intelligence Boosts IRR

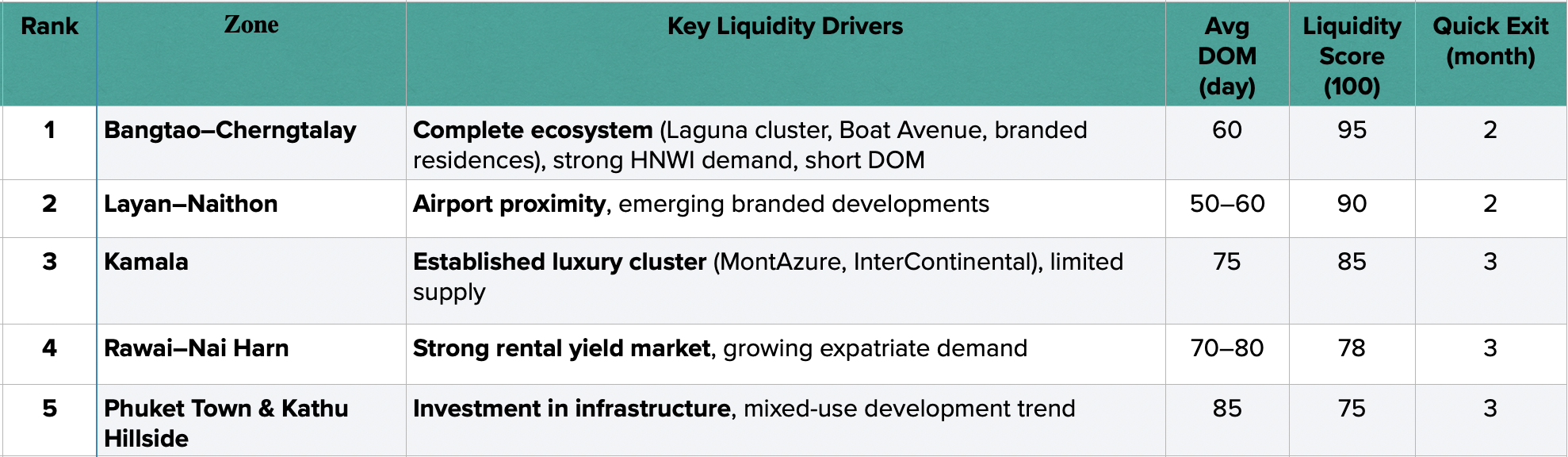

Top 5 Zones for Liquidity & Exit Potential (Phuket, 2025)

Note: DOM values vary based on market conditions and property-specific variables. Figures represent indicative zone averages. For precision, use a CMA (Comparative Market Analysis) for the target asset.

Practical Exit Strategy Checklist

A solid exit plan begins before purchase.

Heres a practical checklist you can apply immediately:

️ Pre-Purchase Vetting

- Request DOM Benchmark: Review 12-month historical DOM for similar assets (e.g., villas >50M in Bangtao) using C9 Hotelworks or Knight Frank data.

- Check Pipeline: Monitor new project launches within 12 - 24 months; oversupply can reduce resale liquidity.

- Calculate Net Proceeds: Review exit taxes, FET requirements, and ownership documentation to estimate true net returns.

During Holding Period

- Active Asset Management: Adopt branded rental or dynamic pricing models to enhance NOI and establish verifiable rental performance.

- Prepare Due Diligence Pack: Keep all key ownership and transfer documents ready (FET, bank confirmations, title deed) to reduce delays during sale execution.

Exit Execution

- Leverage Global Brokerage Networks: Partner with international agents to reach qualified HNWIs before public listing.

- Staged Pricing Strategy: Start with data-backed, realistic pricing (CMA or market comps) to avoid large markdowns later

Liquidity is what separates a "good property from a profitable property."

By integrating Ecosystem Value and Liquidity Factors into your acquisition plan from the start, you can enter and exit the market strategically with measurable, sustainable returns instead of forced discounts.

At Angie Phuket Residences, our role is to act as your Strategic Partner - providing deep CMA insights and connecting you with trusted tax and legal advisors to build a tailored Exit Strategy.

Click here to request your private consultation.

References

- C9 Hotelworks, Phuket Property Market Update (May 2025)

- Knight Frank Thailand, Luxury Property Insights & Residential Review (2024)

- CBRE Thailand, Resort & Villa Market Reports (2024 - 2025)

- INREV Research (2023), Institutional Studies on Liquidity & IRR

- PwC Global Real Estate (2025), Tax & Investment Outlook

© 2025 Angie Phuket Residences.

This article is part of our Investment Vetting Series, curated to help investors navigate the Phuket property market with clarity and confidence.